NY Times article by Warren Buffett: Buy American. I Am.

Partner Site

Tuesday, October 21, 2008

Tuesday, October 14, 2008

Thursday, October 09, 2008

1st CDS Tsunami Wave

First have a look at this (source here):

Now the first numbers are balance sheet assets. Quite big numbers. The second row however have numbers that, to be honest, exceed my imagination. Those numbers consist of all kind of stuff, not only CDSs. Yet, the total market of CDSs might be in the USD 50 to 60 trillion range at this moment.

Now tomorrow on Friday October 10th we will have the auction to settle the Lehman CDSs.

The Big Picture: $400 Billion Lehman CDS Unwind?

NOTIONAL AMOUNT OF DERIVATIVE CONTRACTS

TOP 25 COMMERCIAL BANKS AND TRUST COMPANIES IN DERIVATIVESJUNE 30, 2008, $ MILLIONS

Now the first numbers are balance sheet assets. Quite big numbers. The second row however have numbers that, to be honest, exceed my imagination. Those numbers consist of all kind of stuff, not only CDSs. Yet, the total market of CDSs might be in the USD 50 to 60 trillion range at this moment.

Now tomorrow on Friday October 10th we will have the auction to settle the Lehman CDSs.

The Big Picture: $400 Billion Lehman CDS Unwind?

Early October, Citi (C) credit analyst Michael Hampden-Turner estimated there is $400bn of Lehman credit derivatives that will be settled on FridayFrom The Naked Capitalism blog's comments section

Hence, some recent fear can now be attributed in part to jumbo losses caused by Lehman's derivative unwind . . . with JPMorgan (JPM) being the biggest potential collateral damage . JPM has the biggest derivative exposure on the Street (I have no opinion on how this impacts them or on their derivative exposure).

...

While Fannie and Freddie CDS settled at between 91.5 and 99.9 cents on the dollar., expectations are for Lehman to settle at 10 cent on the dollar -- causing a few $100 billion in losses.

October 9, 2008 10:17 AMAnd from The Big Picture blog's comments section:

Singapore Don said...

LEH CDS auction is tomorrow, October 10. It goes throguh a two stage process, as explained here

http://www.creditfixings.com/information/affiliations/fixings/auctions/current.html

The Fanny/Frerddy settlment went quite smoothly, and the agreed bond values came somewhere betweeen 91 and 99. According to my calculations (no expert), net amount that had to be paid out i.e. loss to protection writers was $1.2 billion. Divide that by 13 active participants, per participant the Fannie/Freddy CDS loss was average under $ 100 million. The Lehman auction clearing price will come out some where between 15 to 20, hopefully higher between 20 and 30. So the loss will be 85% to 70& of NET notional. Although the gross notionals in these CDS contracts are huge, net is usually smaller ( no one knows for sure how much smaller for the market as a whole although each house knows its own position. If Mack knows he has a big exposure on LEH CDS, would he be putting out "we are ok" call to all his boys yesterday?). Freddie/ Fannie Net settlement was $1.2 billion, and the average price was say 96. so the net exposure was approx $30billion. Fannie and Fredddy were the biggest insured names in the CDDS market. So for the Lehnam name, the NET exposure may be much smaller, but the loss per contract would be higher. If we say the Lehman Net Exposure is 20% to 25% of Freddie/Fannie net exposure of $30 billion, it would be around $6 billion to $7.5 billion, and with recovery at say between $50 and $60 billion total systemwide loss. Spread over the 13 major deealers, average is $4 to $ 5 billion, but the spread may be wide I dont know the bank equity analysts and the market has already factored such numbers in, but if the expectation is for lower number, than this may surprise on the upside. If the not, market may take a sigh of relief that the LEH CDS damnage is not so bad,

The only risk is that in the case of Lehman, there is much less netting i.e. the protection writers have huge one sides positions, and my estimates start blowing out.

Not an expert, just trying to decipher the numbers with some commonsense reasoning.

Posted by: The Financial Philosopher | Oct 9, 2008 1:26:31 PMYes, can someone please explain to me wht economical sense there is in buying and selling derivatives over USD 90 trillion e.g. in the case of JP Morgan? If people said, yes, have known it all along, e.g. the UBS balance sheet was growing too big... then what please has been going on here?

Looking at the table of derivatives exposure that Boom2Bust offered up a ways back in this thread, it strikes me as passin' strange that the CDS exposure for the top 3 banks (JPM, BoA, Citi) is so outsized in comparison to their other derivatives exposure.

Almost as if they knew that a big chunk of the CDS they had purchased were vaporous, and had over-committed to compensate for it -- if so, imagine their surprise when so much (all?) of the swaps turned out to be toxic! -- it would have been interesting to also see the CDO exposure for each of these fellas, as I really doubt that they had purchased/sold over a hundred trillion dollars worth of CDOs between the three of them.

It would be nice to see a competent panel of inquisitors (time to bring back the Spanish Inquisition?) grill the managements about this, and if it turned out that yes, they did over-commit because they were suspicious of the quality, then maybe we can find a better use for Gitmo than whatever we are currently using it for.

Or perhaps I am clueless here (there seems to be a lot of that going around recently), and there is a perfectly reasonable explanation for such outsized allocations of CDS that would fall within the envelope of legitimate business practices. If so, would some tolerant and knowledgeable soul please 'splain it to me?

Outlaw CDSs. Now!

From The Big Picture blog comments section:

Posted by: Alan Wilensky | Oct 9, 2008 12:06:14 PMI wholeheartedly agree with this proposal! Take the funny money out of the system with a snap and let's keep going on with our real business. Not possible? Well, everything is possible.

Declare all CDS instruments void and non-negotiable. The Fed and SEC can do this with a little know financial administrative called, "Tough Titty."

The Tough Titty invocation was jsut recently used to spew out the 700 (nee 880) billion dollar bailout, where the Treasury and Fed basically said, "Tough Titty", to the taxpayers.

So, for the CDS unwind, I advocate that the Tough Titty rule be invoked.

CDS Systemic Risk

CDS Systemic risk: a primer about chain settlement risk.

An easy explanation of some theoretical problems with CDSs (and I am not sure this is the real and biggest problem with CDSs). But when you have CDS coverage of USD 60 trillion floating around, this also might be a real practical problem all too soon.

An easy explanation of some theoretical problems with CDSs (and I am not sure this is the real and biggest problem with CDSs). But when you have CDS coverage of USD 60 trillion floating around, this also might be a real practical problem all too soon.

A grossly simplified example will explain it. Party A wishes to place a bet on Frannie default risk by purchasing CDS protection on Frannie. Party A buys protection from B. B is now exposed to the risk of a Frannie default and decides to hedge this risk by buying Frannie CDS protection from party C. C holds the position with net exposure for awhile, gets nervous and then offsets by purchasing protection from Party D, who then offsets the exposure with Party E.

For the sake of simplicity we will assume the default event of Frannie requires $10m in cash or securities to be delivered within 5 business days of the acknowledged default event. Now all of the parties involved have done their risk assessments of their downstream counterparty using various estimates of the counterparties credit quality and liquidity. They have each come to the conclusion, that their next counterparty has a .001% chance of failure at any point in time. They could thus assess the counterparty risk exposure in crude nominal terms as being $10mx 0.01% = $1,000. This feels safe.

Looking individually each party assumes they have $1,000 in risk. In reality A faces $4,000 in probable risk. The chain is only as strong as it weakest link. The end settlement party A has $4,000 exposure (1-(1-.0001)^4)*$1,000. Party B has a $3,000 exposure etc. The longer the chain the greater the systemic risk for the initiator and the potential for a failure to deliver on time etc.

Wednesday, October 08, 2008

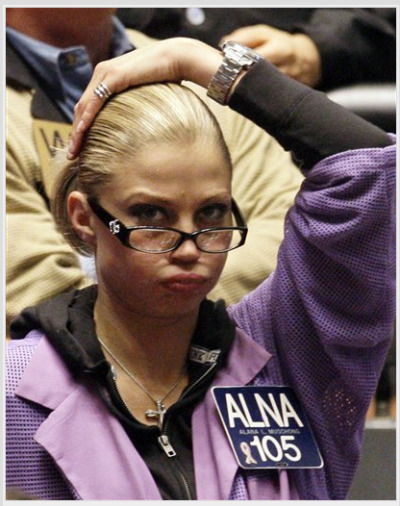

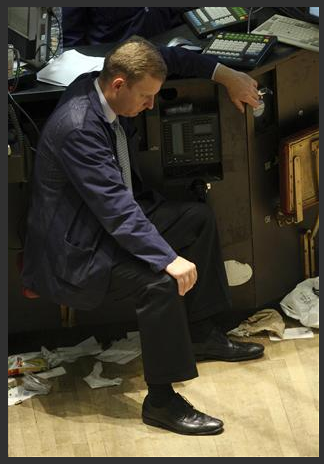

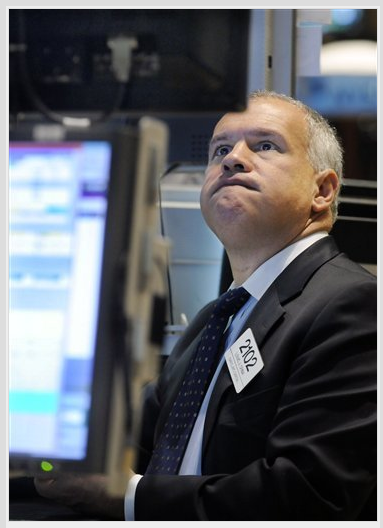

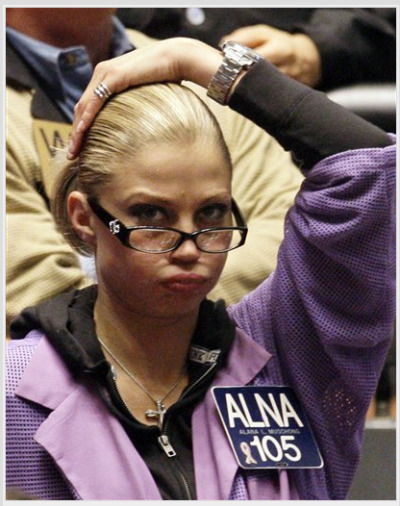

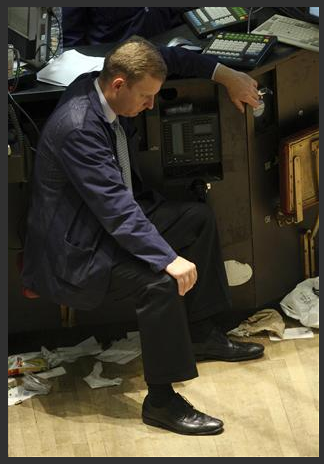

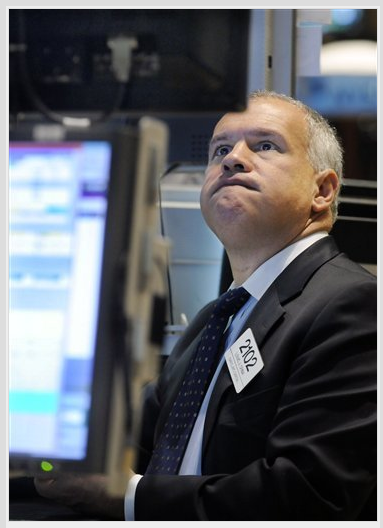

Sad Guys On Trading Floors

C'mon guys, it's just money...

Sad Guys On Trading Floors

Someone made a blog of this. Lot's of interesting face expressions.

Via The Big Picture.

Sad Guys On Trading Floors

Someone made a blog of this. Lot's of interesting face expressions.

Via The Big Picture.

Thursday, October 02, 2008

Wednesday, October 01, 2008

Fear Index

MarketPsych Fear Index

The MarketPsych Fear Index shows a 10-day exponential moving average of the percentage of "Fear" words in the U.S. financial news displayed over a candlestick chart of the Nasdaq 100 (QQQQ).

...

The relative percentage of Fear-related words is on the left y-axis, and the QQQQ value is on the right y-axis. ... We have proprietary technology that detects the predictive values of different types of financial language and concepts, and which underlies our asset management.

Subscribe to:

Posts (Atom)