From the World Gold Council (a bunch of gold mining corporations):

How much gold has been mined?

The best estimates available suggest that the total volume of gold ever mined up to the end of 2009 was approximately 165'000 tonnes, of which around 65% has been mined since 1950.

How much gold is still underground?

The major gold producers increased their reported reserves to 719.7 million oz or over 22,000 tonnes at the end of 2005, according to Metals Economics Group. Assuming a 10% recovery loss when the ore is extracted, this would amount to 14 years of gold production at 2005's level. In practice the amount of known resources remains fairly constant over time since the results of new exploration finds replace those resources that are exploited.

What is the average cost of mining per ounce?

The average cost of replacing and producing an ounce of gold rose to $428/oz in 2005, a ten-year high, according to Metals Economics Group, based on a study of 18 major gold producing companies. However, costs vary widely between companies and the mines themselves.

How big is a tonne of gold?

Gold is traditionally weighed in Troy Ounces (31.1035 grammes). With the density of gold at 19.32 g/cm3, a troy ounce of gold would have a volume of 1.61 cm3. A metric tonne (equals 1,000kg = 32,150.72 troy ounces) of gold would therefore have a volume of 51,762 cm3 (i.e. 1.61 x 32,150.72), which would be equivalent to a cube of side 37.27cm (Approx. 1' 3'').

Where does the word Gold come from?

The word gold appears to be derived from the Indo-European root 'yellow', reflecting one of the most obvious properties of gold. This is reflected in the similarities of the word gold in various languages: Gold (English), Gold(German), Guld (Danish), Gulden (Dutch), Goud (Afrikaans), Gull (Norwegian) and Kulta (Finnish).

With today's gold price of USD 1082.00 the total "market capitalization" of gold is:

USD 5'739'872'784'897.15

USD 5.7 trillion - 9.5% of 2008 world GDP or half of the currently estimated US bailout amount:-)

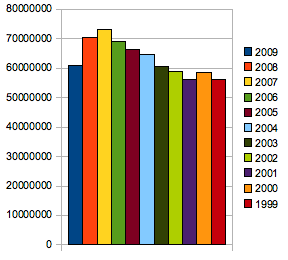

And what's the annual mining production?

The CRB Commoditiy Yearbook 2008 states for 2005:

2'470 t (record high was actually 1999/2000 with

2'570 t)

= 79.41 million ozt (82.6 million ozt)

= USD 85'924'156'234.52

=

USD 85.9 billion (

USD 89.4 billion)

So total world gold amount is equivalent of

66.8 years of 2008 world gold production.

P.S. 1 ozt = 31.1034768 g

And how much gold is there for any human being?165'000'000'000 g / 6'692'030'277 people =

24.66 g / person (or 80% of a single troy once)

Here is an interesting back of the envelope calculation (thought they estimate double the amount of the WGC number and maybe make a too low assumption of today's gold production, nevertheless interesting):

If you took all of the gold in the world and put it in one place how much would there be?And a

National Geographic article about gold, mining, and its social impact:

In 2007 demand outstripped mine production by 59 percent.

...

According to the United Nations Industrial Development Organization (UNIDO), there are between 10 million and 15 million so-called artisanal miners around the world, from Mongolia to Brazil. Employing crude methods that have hardly changed in centuries, they produce about 25 percent of the world's gold and support a total of 100 million people. It's a vital activity for these people—and deadly too.

So annually: 80 mio ozt * 25% = 20 mio ozt; for lets say 10 mio workers this results in 2 ozt per worker, average per worker USD 2'000 market value - thought not what they get:

On school holidays, Rosemery sometimes helps her mother on the mountain. It is child labor, perhaps, but for a girl whose family is living hand to mouth, it also qualifies as her proudest achievement. "Last year I found two grams of gold," Rosemery says, almost giddily. "It was enough to buy my schoolbooks and uniform.

And furthermore:

The deadly effects of mercury are equally hazardous to small-scale miners. Most use mercury to separate gold from rock, spreading poison in both gas and liquid forms. UNIDO estimates that one-third of all mercury released by humans into the environment comes from artisanal gold mining.

...

View Mine Sites in a larger mapAt the other end of the spectrum are vast, open-pit mines run by the world's largest mining companies. Using armadas of supersize machines, these big-footprint mines produce three-quarters of the world's gold. They can also bring jobs, technologies, and development to forgotten frontiers. Gold mining, however, generates more waste per ounce than any other metal, and the mines' mind-bending disparities of scale show why: These gashes in the Earth are so massive they can be seen from space, yet the particles being mined in them are so microscopic that, in many cases, more than 200 could fit on the head of a pin. Even at showcase mines, such as Newmont Mining Corporation's Batu Hijau operation in eastern Indonesia, where $600 million has been spent to mitigate the environmental impact, there is no avoiding the brutal calculus of gold mining. Extracting a single ounce of gold there—the amount in a typical wedding ring—requires the removal of more than 250 tons of rock and ore.

...

Up the road there is a basketball gymnasium that Newmont staffers jokingly refer to as "the second home of the Denver Nuggets."

The name is fitting for a Colorado-based gold-mining company, though there are no nuggets here. And therein lies the problem. Higher prices and advanced techniques enable companies to profitably mine microscopic flecks of gold; to separate gold and copper from rock at Batu Hijau, Newmont uses a finely tuned flotation technology that is nontoxic, unlike the potentially toxic cyanide "heap leaching" the company uses in some of its other mines. Even so, no technology can make the massive waste generated by mining magically disappear. It takes less than 16 hours to accumulate more tons of waste here than all of the tons of gold mined in human history. The waste comes in two forms: discarded rock, which is piled into flat-topped mountains spread across what used to be pristine rain forest, and tailings, the effluent from chemical processing that Newmont pipes to the bottom of the sea.

This method of "submarine tailings disposal" is effectively banned in most developed countries because of the damage the metal-heavy waste can do to the ocean environment, and Newmont practices it nowhere but in Indonesia. Four years ago an Indonesian court brought criminal charges against a Newmont subsidiary—even jailing five of its employees for a month—for pumping pollutants into the sea near its now defunct Buyat Bay mine on the island of Sulawesi. Newmont was acquitted of all charges in 2007. Despite critics' claims that the court caved in to the mining industry, Newmont defends its reliance on ocean dumping at Batu Hijau. "Land disposal would be cheaper but more damaging to the environment," argues Rachmat Makkasau, Batu Hijau's senior process manager. The tailings at Batu Hijau are released 2.1 miles offshore at a depth of 400 feet, above a steep drop-off that carries the waste down more than 10,000 feet. "We closely monitor the quality of the tailings, pipes, and seabed," says Makkasau. "At that depth, we are only affecting some 'sea insects.'"

...

Nowhere is the gold obsession more culturally entrenched than it is in India. Per capita income in this country of a billion people is $2,700, but it has been the world's runaway leader in gold demand for several decades. In 2007, India consumed 773.6 tons of gold, about 20 percent of the world gold market and more than double that purchased by either of its closest followers, China (363.3 tons) and the U.S. (278.1 tons). India produces very little gold of its own, but its citizens have hoarded up to 18,000 tons of the yellow metal—more than 40 times the amount held in the country's central bank.

India's fixation stems not simply from a love of extravagance or the rising prosperity of an emerging middle class. For Muslims, Hindus, Sikhs, and Christians alike, gold plays a central role at nearly every turning point in life—most of all when a couple marries. There are some ten million weddings in India every year, and in all but a few, gold is crucial both to the spectacle and to the culturally freighted transaction between families and generations. "It's written into our DNA," says K. A. Babu, a manager at the Alapatt jewelry store in the southwestern city of Cochin. "Gold equals good fortune."

This equation manifests itself most palpably during the springtime festival of Akshaya Tritiya, considered the most auspicious day to buy gold on the Hindu calendar. The quantity of gold jewelry Indians purchase on this day—49 tons in 2008—so exceeds the amount bought on any other day of the year throughout the world that it often nudges gold prices higher.

View Larger MapThroughout the year, though, the epicenter of gold consumption is Kerala, a relatively prosperous state on India's southern tip that claims just 3 percent of the country's population but 7 to 8 percent of its gold market. It's an unusual distinction for a region that has one of the world's only democratically elected Marxist governments, but it is rooted in history. A key port in the global spice trade, Kerala gained an early exposure to gold, from the Romans who offered coins in exchange for pepper, cardamom, and cinnamon to subsequent waves of colonizers, the Portuguese, Dutch, English. But local historians say it was the region's revolt against the Hindu caste system (before which the lowest castes were allowed to adorn themselves only with polished stones and bones), and the mass conversion to Christianity and Islam that followed, that turned gold into something more than commerce: a powerful symbol of independence and upward mobility.

...

By themselves, none of these ceremonies captures how deeply gold is ingrained in the Indian economy. "Gold is the basis of our financial system," says Babu, the jewelry store manager. "People see it as the best form of security, and nothing else lets you get cash as quickly." Hoarding gold as an intergenerational family nest egg is an ancient tradition in India. So, too, is pawning gold jewelry for emergency loans—and then buying it back. Commercial banks still offer the service, after their attempt to stop it in the 1990s resulted in riots and suicides by debt-laden clients and a government command to continue the practice.

Many farmers in Kerala, however, prefer the speed and easy access of "private financiers" like George Varghese, who operates out of his home three hours south of Cochin. A balding man in his 70s, Varghese says he handles around half a million dollars in pawned gold a month, even more during harvest and wedding seasons. It's almost a perfect business, for even with interest rates that can reach one percent a day on short-term loans, very few people default. No Indian wants to let go of their gold. "Even when gold hit $1,000 an ounce, nobody sold their jewelry or coins," says Varghese. "This is their nest egg, and they trust it to keep growing."

...

In small-scale gold mining, UNIDO estimates, two to five grams of mercury are released into the environment for every gram of gold recovered—a staggering statistic, given that mercury poisoning can cause severe damage to the nervous system and all major organs. According to Peruvian environmentalists, the mercury released at La Rinconada and the nearby mining town of Ananea is contaminating rivers and lakes down to the coast of Lake Titicaca, more than a hundred miles away.

View Larger Map